Be aware of these tax scams.

A startup company aims to cut hold times for taxpayers calling the IRS – please read below article for more information….and while you are reading please enjoy this classic by the Kinks…

New Service Aims to Cut IRS Phone Call Hold Times

(FEBRUARY 3, 2016)

BY MICHAEL COHN

A startup is trying to reduce the amount of time taxpayers spend on hold with the Internal Revenue Service this tax season.

The company, enQ Inc., launched its service last Wednesday. “We call the IRS, and sell our place on hold to our customers,” said Andrew Valiente, founder of the Walnut, Calif.-based company. “This means our customers can cut their hold times when calling the IRS from hours to minutes. While there are similar existing services (for example, Lucy Phone and Fast Customer), both of these options rely on a return call from a customer service agent. We put our customers directly in touch with a customer service agent, without waiting for a return phone call.”

He pointed to a recent Government Accountability Office study that found a declining rate of taxpayer service by the IRS. A GAO report released last month found the IRS provided the lowest level of telephone service in fiscal year 2015 compared to prior years. Only 38 percent of callers who wanted to speak with an IRS assistor were able to reach one. Since 2010, average wait times have almost tripled to over 30 minutes.

An IRS spokesman declined to comment on enQ’s plans.

IRS Commissioner John Koskinen told reporters during a press conference last month that he hopes to improve the rate of callers who get through to the IRS this tax season to 60 percent and to reduce wait times to under 20 minutes, thanks to an extra $290 million in funds that Congress earmarked last December to improve IRS taxpayer service, cybersecurity and identity theft protection (see IRS Expects to Improve Taxpayer Service This Season). He also expects to make the dedicated Practitioner Priority Line for tax professionals more functional.

Valiente said enQ pre-emptively calls the IRS and establishes a line on hold. It then sells the place on hold to customers, so customers spend less time waiting on hold to talk to the IRS. The company also plans to set up similar services for customers who are trying to call the Social Security Administration and tax authorities in the United Kingdom.

For more information, visit www.callenq.com.

eTax Alert™

Supreme Court Rules Constitution Guarantees Right to Same-Sex Marriage

On June 26, 2015, the Supreme Court ruled that the U.S. Constitution guarantees the right of same-sex marriage and requires all state governments to recognize marriages regardless of gender (see Obergefell v. Hodges, 14–556). This is a long-sought victory for the gay rights movement.

The 5-4 decision, a culmination of decades of litigation and activism, came against the backdrop of changes in public opinion. Polls indicated that most Americans now approve same-sex marriage. Prior to today’s decision, 37 states (up from fewer than 20), plus the District of Columbia, have legalized same-sex marriage in the 2 years since the court’s decision in United States v. Windsor in June 2013.

Proponents argued that marriage is a fundamental right for any two people, regardless of gender, and that due process and equal protection clauses of the Constitution give gays and lesbians equal marriage rights. Over 75 briefs were submitted to the court, including from major business leaders and most Democrats in Congress.

Same-sex couples face the same financial constraints as opposite-sex married couples, including the marriage penalty in taxation. While social service providers normally do not count one partner’s assets toward the income means test for welfare and disability assistance for the other partner, a legally married couple’s joint assets are normally used to calculate whether or not a married individual qualifies for assistance.

Prior to the June 26, 2015, Supreme Court decision, same-sex couples faced both financial and legal disadvantages, including but not limited to:

- Legal costs associated with obtaining domestic partner documents, including powers of attorney.

- Decisions regarding inheritance. Opposite-sex married couples can inherit an unlimited amount from a deceased spouse without incurring estate taxes, but same-sex partners were subject to inheritance taxes.

- Same-sex couples were not eligible to file jointly as married couples; therefore, they could not take advantage of lower tax rates if the individual income of the partners differed significantly.

- Employer-provided health insurance coverage for same-sex partners incurred federal income tax.

Same-sex couples faced higher health care costs associated with a lack of insurance and preventative care.

I could not resist posting this.

“CAMDEN, MN—While filling out a 1040 form and other documents Tuesday in preparation for filing his 2012 federal tax returns, local man Robert Moran, a blog writer who will shortly be audited by the Internal Revenue Service, announced that his calculations seem to all add up fine. “Well, I’m self-employed and work mostly from the kitchen, which takes up about a third of my apartment, so that means I can deduct about $6,000 for rent plus all the repairs to the sink and refrigerator, and, yeah, that seems more or less right,” reported the man who will soon be audited by the IRS on suspicion of tax fraud and found to owe the federal government over $14,000 in unpaid taxes in addition to interest and a 20 percent penalty for disallowed deductions. “Plus I had to buy a TV and a DVD player to watch all the shows I blog about, which is another $1,500, and an iPhone that runs about $60 per month. Good thing you’re allowed to write off these business expenses.” At press time, Moran was telling himself that the IRS doesn’t look closely at people like him.”

As some of you may know, Don and I enjoy a little glass of whiskey every now and again. And not just any whiskey. We prefer Bushmills whiskey and have visited the Bushmills distillery at least a half a dozen times. On this St. Patrick’s Day, we wish that all of you can some day visit the Bushmills Inn (just up the street from the distillery, and pictured below) and enjoy the world famous water of life while sitting in the Inn’s snug in front of the peat fire. It is, without a doubt, one of the more enjoyable experiences life has to offer. Slainte!

The government estimates that 6 million people will owe a penalty on their 2014 return for failure to obtain qualifying health insurance. Some of those penalties arise from a personal objection to ACA’s individual mandate; others will pay a penalty because they were unaware of the options and subsidies available at healthcare.gov. In an effort to help the later group and to tap into the tax practitioner’s expertise in advising clients about ACA, the Center for Medicare and Medicaid Services (CMS) announced a special tax season enrollment period for those who failed to enroll in 2014. Although the official 2015 enrollment period ended February 15, 2015, a special enrollment period for the 2015 plan year will be available March 15, 2015 to April 30, 2015.

Who qualifies for the special enrollment period?

CMS Announcement 2015-02-20 provides that the special enrollment period is only available for those:

- Living in a state with a federally-facilitated marketplace (healthcare.gov),

- Who paid a shared responsibility penalty on their 2014 return

- Who attest that they first became aware, or understood the implications of the shared responsibility penalty after February 15, 2015 in connection with filing their 2014 tax return.

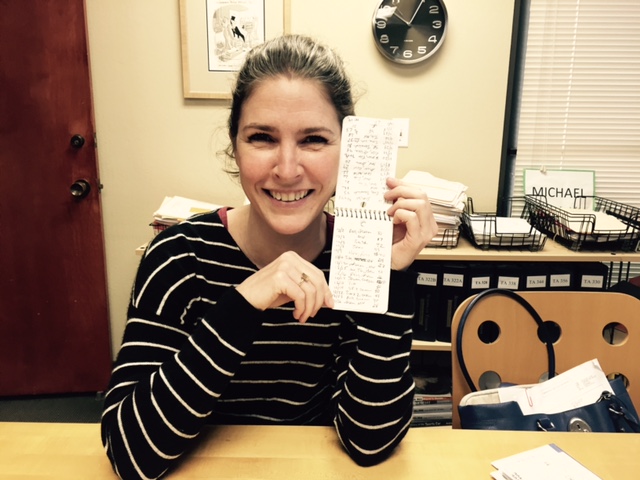

When CPAs go to tax conferences, there are usually some shared observations about our clients. One such observation is that clients never seem to keep the IRS required mileage log to substantiate business use of their vehicle(s). Most clients ask “oh, what was it last year?” while others look out the window or up to the ceiling in an effort to find a reasonable number that won’t make us raise an eyebrow. Today, however, Leslie, pictured below, proved that it can be done. Leslie, on behalf of the IRS and CPAs everywhere – thank you!

Here at Shaw + Shaw we work hard for our clients. Especially this time of year. And that’s why it is important for us to savor the beauty in every day. One of my favorite moments during tax season is to arrive at the office on a sunny morning and notice the cherry blossoms blooming on the trees outside. It’s a glorious sight. Please, enjoy…